In today’s fast-paced world, the way we manage and exchange money has drastically evolved. Digital tools have reshaped how we handle financial transactions, offering users a more efficient, secure, and convenient method for managing their assets. As traditional methods of payment give way to digital innovations, more people are opting for solutions that provide seamless, instant financial management.

These tools not only streamline payments but also enhance security, making them essential for anyone navigating the digital economy. From handling small purchases to managing larger financial transfers, these platforms offer flexibility that is changing the way we interact with money. With a rise in the adoption of such technologies, understanding their impact on both personal and business finances becomes crucial tg wallet.

By exploring these modern solutions, users can unlock new ways to control their financial landscape, with an emphasis on ease of use, security, and innovation.

Exploring the Features of Digital Payment Solutions

Digital payment solutions have rapidly become a key part of the financial landscape. These platforms offer users a variety of tools designed to simplify financial transactions while maintaining high levels of security. With their ability to facilitate everything from daily purchases to larger transfers, these solutions have redefined how we handle our finances.

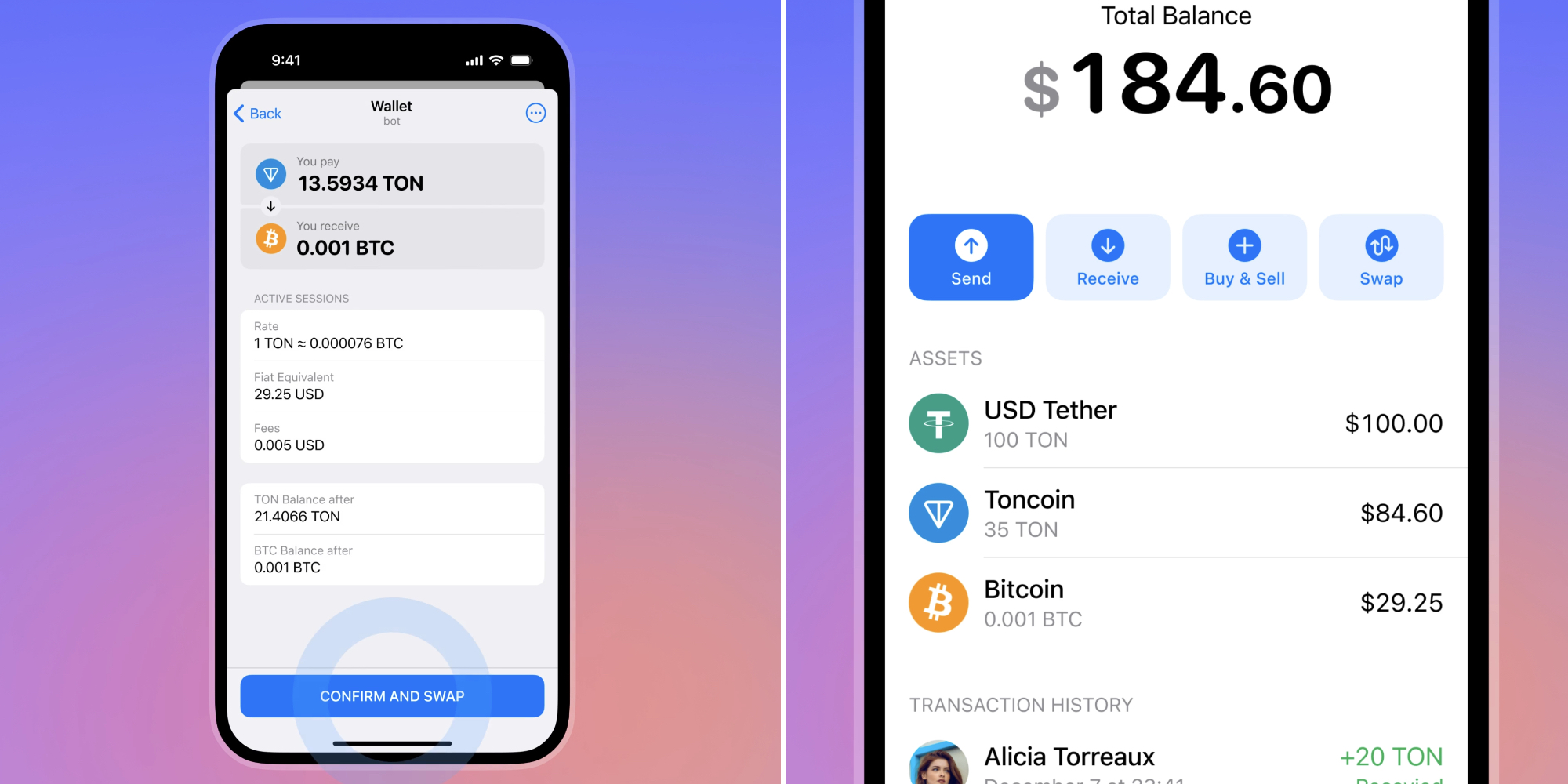

Among the most notable features of digital payment systems is their convenience. Users can complete transactions in just a few taps, whether it's paying for goods online, transferring funds to friends, or managing investments. The systems also provide an array of options for linking and integrating bank accounts, making payments faster and more efficient.

Another critical feature is security. Advanced encryption protocols and multi-factor authentication ensure that sensitive information is protected. These systems use cutting-edge technology to guard against fraud, offering users peace of mind when making transactions online.

How Technology Simplifies Financial Management

In today's fast-paced world, managing finances can be a daunting task. However, technology has made it easier than ever to stay on top of personal and business finances. By offering innovative solutions that automate and streamline financial tasks, technology empowers individuals and businesses to manage their money efficiently and with greater control.

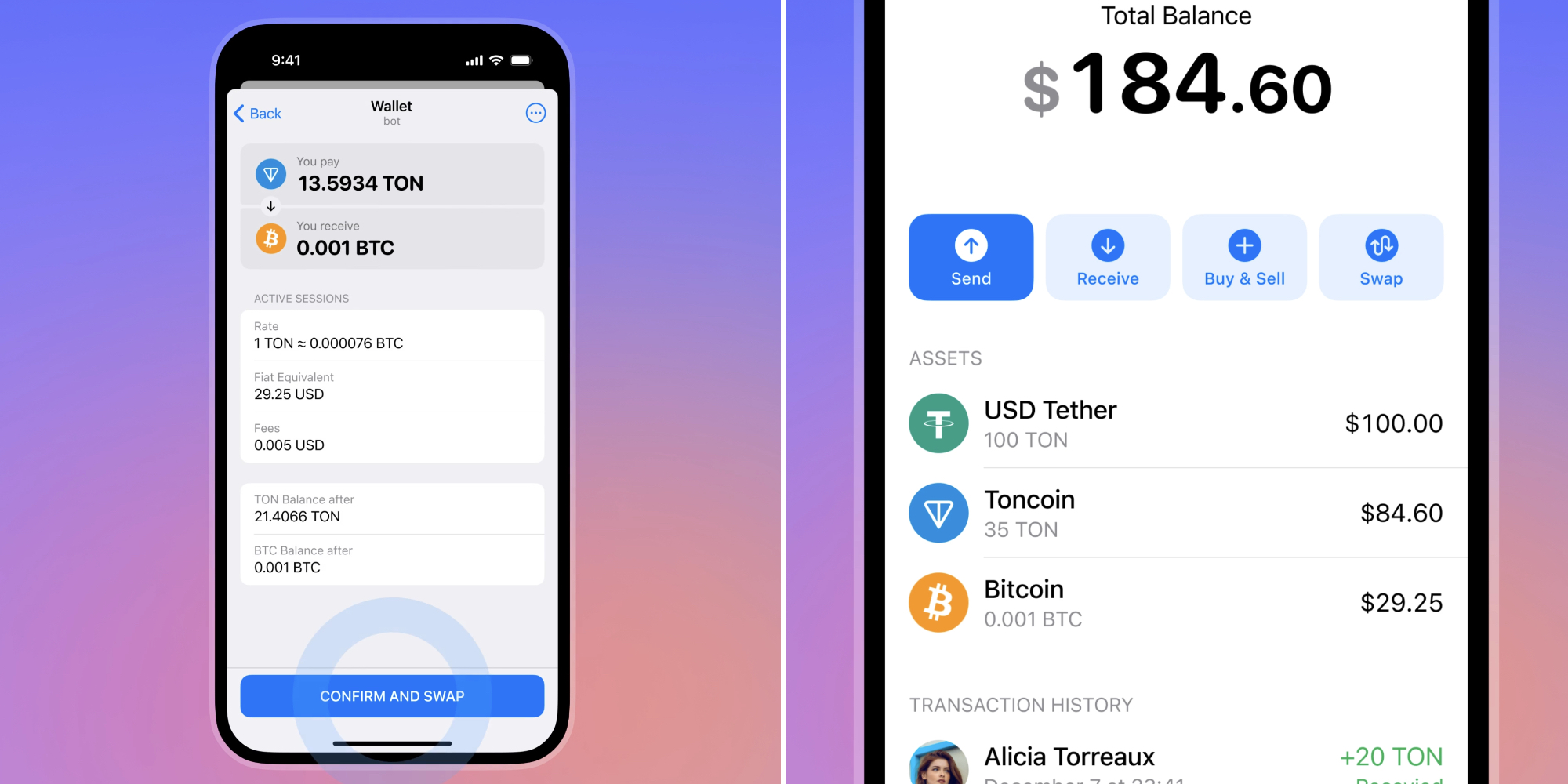

One of the key ways technology simplifies financial management is through automation. Many platforms now offer features like automated bill payments, recurring transfers, and real-time budgeting. This eliminates the need for manual tracking, ensuring that individuals and companies never miss important payments or exceed their budgets.

Additionally, digital tools offer enhanced visibility and insight into spending habits. With detailed reports and real-time data, users can easily track income and expenses, making it easier to identify patterns, optimize savings, and adjust financial strategies. These tools not only improve decision-making but also increase financial literacy among users.

© 2010-2024 RaNet&Co., Ltd., Ukraine, Kiev

Generation time:0.13

© 2010-2024 RaNet&Co., Ltd., Ukraine, Kiev

Generation time:0.13